● FreightHub is a leading digital freight marketplace, broker, and provider of transportation

management systems focused on truckload freight

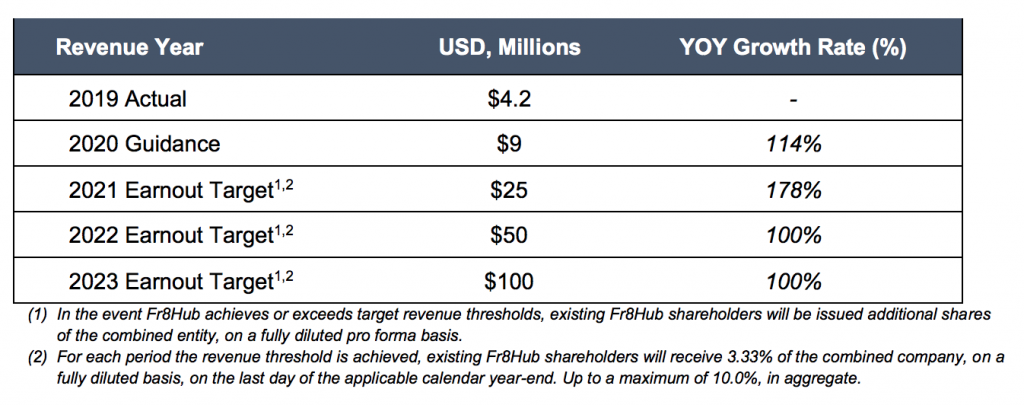

● FreightHub expects 100% growth year over year with 2020 annual revenue to be

in excess of $9 million

● Annual revenue earnout targets: $25 million for 2021, $50 million for 2022 and $100 million for

2023

● Existing FreightHub stockholders intend to finance $12 million in connection with the closing of

the merger

● Mike Flinker, FreightHub’s President, brings 30 years of cross-border transportation industry

experience

● Conference call to review business combination today at 5:30 am PT/8:30 am ET

NEW YORK, October 15, 2020 (GLOBE NEWSWIRE) — Hudson Capital Inc. (NASDAQ: HUSN)

(Hudson Capital) has entered into a definitive merger agreement to acquire FreightHub, Inc.

(Fr8Hub), a North American transportation logistics platform company focused on US-Mexico crossborder shipping. Existing Fr8Hub shareholders intend to invest $12 million in connection with the

closing of the transaction. The transaction is expected to close in the first quarter of 2021.

Fr8Hub is simplifying domestic and international cross-border shipping through its cloud-based

transportation logistics platform. The company’s digital freight marketplace, transportation

management systems (TMS), public application programming interface (API), and customer support

tools have been designed to maximize efficiency from scheduling to delivery for shippers and

carriers. Fr8Hub’s innovative digital freight matching technology connects shippers with a broad

network of reliable carriers and drivers in Mexico, Canada and the United States’ borders. The

company’s proprietary platform enables shippers to autonomously manage their own fleet and post

loads in the marketplace to minimize dead space and, at the same time, seamlessly integrate with

third-party systems to streamline communication amongst partners. Altogether, Fr8Hub’s mission is

to make shipping simple, transparent, and efficient.

Hon Man Yun, Chief Financial Officer of Hudson Capital, stated, “With its differentiated technology

platform, first mover advantage and extensive management experience and expertise, Fr8Hub is

well positioned to capitalize on the expanding truckload freight industry cross-border between the

United States and Mexico. After three years of innovative software development, the company

began selling Fr8Hub 2.0 in earnest in June. Since that time, they have seen extraordinary monthover-month revenue growth.”

With Fr8Hub 2.0 software in place, Fr8Hub’s monthly revenue grew from $247,000 in May 2020 to

over $1.0 million in September 2020. With this press release, Fr8Hub management is providing full

year 2020 revenue guidance to be in excess of $9 million.

Yun added, “Fr8Hub’s President Mike Flinker has more than 30 years of logistics business

experience with a focus on cross-border and domestic commercial freight. Fr8Hub plans to build

upon its market-leading transportation logistics platform, leveraging its innovative, proprietary

technology and significant industry expertise.”

Flinker said, “We believe we are the first mover in Mexico to combine a top-tier transportation

logistics platform with an intimate knowledge of over the road cross-border shipping, especially in

relation to the US-Mexico border. Being a publicly traded company will enable us to build a market

leading position serving the $40 billion trucking industry in Mexico. Mexico is now the United States’

second largest trading partner, with cross-border trading between the two countries totaling

approximately $429 billion, according to the United States Department of Transportation. As an

established digital freight marketplace broker, we are well-positioned for growth domestically in both

countries, beginning in Mexico, where the fragmented industry provides a great opportunity for

consolidation. Additionally, we plan to leverage our technology to expand our shipper TMS to include

a carrier fleet management system and last mile solution. These growth initiatives help substantiate

the basis for our revenue earnout targets.”

Fr8Hub has exhibited month-over-month revenue growth while introducing its next generation of

software, Fr8Hub 2.0, and further establishing the company amongst its peers in the digital freight

sector, including Uber Freight LLC, Convoy Inc, Transfix, Inc, and NEXT Trucking Inc.

The merger agreement includes a revenue earnout schedule. The following shows the 2020 guided

revenue and the 2021, 2022, and 2023 revenue earnouts targets:

Consummation of the merger will require approval of the shareholders of both Hudson Capital and

Fr8Hub and is subject to other customary closing conditions, including the receipt of listing approval

of the post-closing company by The Nasdaq Stock Market, LLC and the completion of the review of

the Registration Statement on Form S-4 to be filed with the SEC in connection with the proposed

merger.

If all requisite approvals are obtained, the transaction , will result in the redomestication of Hudson

Capital from the British Virgin Islands to Delaware and the acquisition of Fr8Hub as a wholly-owned

subsidiary of Hudson Capital.

More About Fr8Hub

Fr8Hub’s online freight marketplace and mobile application give carriers full visibility on all of the

company’s freight capabilities and gives them the ability to book shipments instantly through

Fr8Hub’s app or web-based portal. The company also offers a cloud-based TMS solution to assist

with maximizing the efficiency of transportation operations.

Fr8Hub helps its customers optimize their supply chain, eliminate empty miles on the road, and

reduce their carbon footprint, thereby improving profitability and environmental sustainability. A

transformation in the logistics transportation industry is taking place and Fr8Hub offers smart

solutions with its proprietary software creating sustainable alternatives. Companies need to stay

competitive – Fr8Hub’s advanced technology aims to improve customer distribution centers,

warehouses, shipping, and transport management.

Founded in 2015, Fr8Hub delivered gross revenue of $4.2 million in 2019 and estimates 2020 to

grow more than 100% organically. With 1,700+ carriers (80,000+ trucks) onboarded and 130+

shipper clients through September 2020, Fr8Hub has facilitated/completed 7,800+ shipping loads.

US headquarters are in Chicago and Mexican headquarters are in Monterrey. As of September 30,

2020, Fr8Hub has 68 employees, 52 in Mexico and16 in the United States.

Transaction Overview

Immediately following the closing of the merger, the former Fr8Hub shareholders will hold

approximately 85.7% of the combined company and the shareholders of Hudson Capital will retain

ownership of approximately 14.3% of the combined company, on a fully diluted basis. Additionally,

Fr8Hub will make a cash payment of $1.75 million to Hudson at closing. The Merger Agreement

includes a revenue earnout schedule, based upon Fr8Hub achieving annual revenue thresholds of

$25 million, $50 million and $100 million in 2021, 2022, and 2023, respectively. In the event Fr8Hub

meets these annual revenue thresholds, existing Fr8Hub stockholders shall receive (on a pro rata

basis) 3.33% of the issued and outstanding shares of common stock, in the combined company, on

a fully-diluted basis as of the last day of the applicable calendar year-end, up to a maximum of

10.0% in the aggregate over the three year period. Finally, the current assets and liabilities of

Hudson will be spun-off to existing shareholders of Hudson immediately prior to the closing of the

transaction.

Upon completion of the merger, the existing Fr8Hub board will lead the merged company and Mike

Flinker will serve as President and Director.

Chardan is acting as exclusive advisor to Fr8Hub on the proposed transaction and Loeb & Loeb LLP

is acting as legal counsel. Block Wall Advisors is acting as exclusive advisor to Hudson Capital and

Sichenzia Ross Ference LLP is acting as legal counsel to Hudson Capital.

The Boards of Directors of each of Hudson Capital and Fr8Hub have unanimously approved the

transaction. The transaction will require the approval of the shareholders of both Hudson Capital and

Fr8Hub, and is subject to other customary closing conditions, including the receipt of approval from

The Nasdaq Stock Market, LLC and the completion of the review of the Registration Statement on

Form S-4 to be filed with the SEC in connection with the proposed merger. The transaction is

expected to close early in the first quarter of 2021. Additional information about the proposed

transaction, including a copy of the merger agreement and investor presentation, will be provided in

a Form 6-K to be filed by Hudson Capital with the Securities and Exchange Commission and will be

available at www.sec.gov.

Management’s Prepared Remarks

Hudson Capital and Fr8Hub management will host a conference call with management’s prepared

remarks today at 8:30am ET/ 5:30am PT to discuss the proposed business combination. The

webcast for the call can be accessed from Fr8Hub’s website at www.fr8hub.com. Alternatively, you

may dial the following number up to ten minutes prior to the scheduled conference call time: 1-877-

423-9813. International callers should dial 1-201-689-8573. The pass code will be 13711973.

If you are unable to participate in the live call, the webcast will be archived for replay on Fr8Hub’s

website for one year. In addition, a telephonic replay will be available at 11:30 a.m. Eastern Time on

Thursday, October 15, 2020, through 11:59 p.m. Eastern Time on Thursday, October 22, 2020. To

access the replay, please dial 1-844-512-2921. International callers should dial 1-412-317-6671.

The pass code will be 13711973.

About FreightHub, Inc.

FreightHub, Inc. (Fr8Hub) makes shipping simple, transparent, and efficient. A transportation

logistics platform company, Fr8Hub focuses on truckload freight for US-Mexico cross-border,

domestic Mexico and domestic US. As an established digital freight marketplace, broker,

transportation management system (TMS) and public API, Fr8Hub uses its proprietary technology

platform to connect carriers and shippers and significantly improve matching and operation efficiency

via innovative technologies such as live pricing and real-time tracking.

About Hudson Capital Inc.

Incorporated in 2014, Hudson Capital Inc. (formerly known as China Internet Nationwide Financial

Services Inc. (NASDAQ: HUSN)) commenced its business by providing financial advisory services to

small and medium size companies. The traditional business segments include commercial payment

advisory, intermediary bank loan advisory and international corporate financing advisory services

which help clients to meet their commercial payment and investment needs. For more information,

about Hudson Capital, please see the documents filed by Hudson Capital with the SEC at

www.sec.gov.

Important Information About the Proposed Merger Transaction and Where to Find It

In connection with the proposed merger, Hudson Capital intends to file relevant materials with the

Securities and Exchange Commission (the “SEC”), including a Registration Statement on Form S-4

(the “Form S-4”), which includes and serves as a proxy statement/prospectus for Hudson Capital’s

shareholders and a prospectus for Fr8Hub’s stockholders. Promptly after the Form S-4 is declared

effective by the SEC, Hudson Capital will mail the definitive proxy statement/prospectus and a proxy

card to each shareholder entitled to vote at the special meeting on the merger and the other

proposals set forth in the proxy statement. SHAREHOLDERS OF HUDSON CAPITAL ARE URGED

TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE MERGER

THAT HUDSON CAPITAL WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT HUDSON CAPITAL,

FREIGHTHUB AND THE MERGER. The definitive proxy statement/prospectus and other relevant

materials in connection with the merger (when they become available), and any other documents

filed by Hudson Capital with the SEC, may be obtained free of charge at the SEC’s website

(www.sec.gov).

Participants in the Solicitation

Hudson Capital and its directors and executive officers may be deemed participants in the

solicitation of proxies from Hudson Capital’s shareholders with respect to the merger. A list of the

names of those directors and executive officers and a description of their interests in Hudson Capital

will be included in the prospectus/proxy statement for the proposed merger and be available at

www.sec.gov. Additional information regarding the interests of such participants will be contained in

the prospectus/proxy statement for the proposed merger when available. Information about Hudson

Capital’s directors and executive officers and their ownership of ordinary shares of Hudson Capital is

set forth in Hudson Capital’s Annual Report on Form 20-F filed with the Securities and Exchange

Commission on June 15, 2020, These documents can be obtained free of charge from the sources

indicated above.

Fr8Hub and its directors and executive officers may also be deemed to be participants in th

solicitation of proxies from the shareholders of Hudson Capital in connection with the proposed

merger. A list of the names of such directors and executive officers and information regarding their

interests in the proposed merger will be included in the prospectus/proxy statement for the proposed

merger.

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor”

provisions of the United States Private Securities Litigation Reform Act of 1995. Hudson Capital’s

and Fr8Hub’s actual results may differ from their expectations, estimates, and projections and,

consequently, you should not rely on these forward-looking statements as predictions of future

events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,”

“plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar

expressions (or the negative versions of such words or expressions) are intended to identify such

forward-looking statements. These forward-looking statements include, without limitation, Hudson

Capital’s and Fr8Hub’s expectations with respect to future performance and anticipated financial

impacts of the proposed acquisition, the satisfaction of the closing conditions to the proposed

acquisition, and the timing of the completion of the proposed acquisition.

These forward-looking statements involve significant risks and uncertainties that could cause the

actual results to differ materially from those discussed in the forward-looking statements. Most of

these factors are outside Hudson Capital’s and Fr8Hub’s control and are difficult to predict. Factors

that may cause such differences include, but are not limited to: (1) the occurrence of any event,

change, or other circumstances that could give rise to the termination of the definitive merger

agreement (the “Agreement”); (2) the outcome of any legal proceedings that may be instituted

against Hudson Capital or Fr8Hub following the announcement of the Agreement and the

transactions contemplated therein; (3) the inability to complete the proposed acquisition, including

due to failure to obtain approval of the shareholders of Hudson Capital and stockholders of Fr8Hub,

certain regulatory approvals, or satisfy other conditions to closing in the Agreement; (4) the

occurrence of any event, change, or other circumstance that could give rise to the termination of the

Agreement or could otherwise cause the transaction to fail to close; (5) the impact of COVID-19

pandemic on Fr8Hub’s business and/or the ability of the parties to complete the proposed

acquisition; (6) the inability to obtain or maintain the listing of Hudson Capital’s shares of common

stock on Nasdaq following the proposed merger; (7) the risk that the proposed acquisition disrupts

current plans and operations as a result of the announcement and consummation of the proposed

merger; (8) the ability to recognize the anticipated benefits of the proposed merger, which may be

affected by, among other things, competition, the ability of Fr8Hub to grow and manage growth

profitably, and retain its key employees; (9) costs related to the proposed merger; (10) changes in

applicable laws or regulations; (11) the possibility that Hudson Capital or Fr8Hub may be adversely

affected by other economic, business, and/or competitive factors; (12) risks relating to the

uncertainty of the projected financial information with respect to Fr8Hub; (13) risks related to the

organic and inorganic growth of Fr8Hub’s business and the timing of expected business milestones;

and (14) other risks and uncertainties indicated from time to time in the prospectus/proxy statement

on the Form S-4, relating to the proposed merger, including those under “Risk Factors” therein, to be

filed by Hudson Capital and in Hudson Capital’s other filings with the SEC. Hudson Capital cautions

that the foregoing list of factors is not exclusive. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking statements. Hudson Capital and Fr8Hub

caution readers not to place undue reliance upon any forward-looking statements, which speak only

as of the date made. Hudson Capital and Fr8Hub do not undertake or accept any obligation or

undertaking to release publicly any updates or revisions to any forward-looking statements to reflect

any change in their expectations or any change in events, conditions, or circumstances on which any

such statement is based.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent, or authorization with respect

to any securities or in respect of the proposed merger. This press release shall also not constitute an

offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of

the Securities Act of 1933, as amended, or an exemption therefrom.

Fr8Hub Contact:

Moriah Shilton or Kirsten Chapman, LHA Investor Relations, fr8hub@lhai.com, 415.433.3777

Hudson Capital Contact:

Hon Man Yun, Chief Financial Officer, man@hudsoncapitalusa.com, (852) 98047102

Source: bit.ly/33YmfPa